Watch the Session

YouTube: https://youtu.be/py7zEb_rzQs

This post is part of Greenwood Law’s Lunch & Learn series on practical estate‑planning topics. In the featured video, James Greenwood is joined by Benjamin T. Young and Steph C. Iasiello for a deep dive on powers of attorney (POAs)—what they are, how they work across state lines, and concrete steps to keep banks and hospitals from saying ‘no.’

What is a Power of Attorney—and why it matters

A Power of Attorney (POA) lets you name a trusted agent to act for you. In estate planning we rely on two core POAs:

- Financial/Property POA – for banking, bills, contracts, taxes, and everyday finances.

- Healthcare/Medical POA – for medical decision‑making and access to health information.

Every state sets its own execution rules (e.g., notary/witness requirements) and recognized powers, so a document valid in one state may look unfamiliar in another—even when it’s legally effective. That mismatch is often what triggers bank or hospital pushback.

The cross‑border reality: ‘Legal’ vs. ‘Practical’

Legally, if a POA was validly executed where and when it was signed, it should be accepted elsewhere. Practically, large institutions often default to ‘our form only’ or escalate unfamiliar documents for review, causing delays—especially hard when the principal is hospitalized or has diminished capacity.

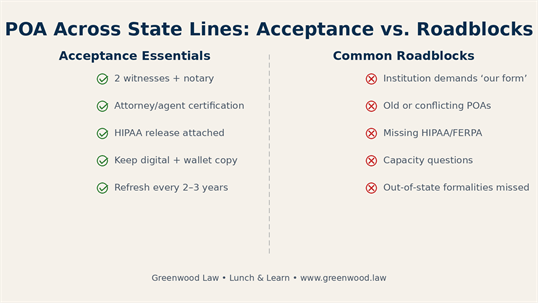

Tactics that help in the real world:

- Use above‑minimum execution formalities. Some states commonly expect two witnesses and a notary. Even if your home state requires less, signing with two witnesses + notary reduces friction if your POA lands on a two witness state‑based institution’s desk.

- Include (or obtain) a ‘Certification of POA.’ An attorney’s certification that the POA was validly executed and remains in effect can help with banks and hospitals. Our Illinois forms integrate this; Georgia practice often uses an agent certification.

- Know state‑by‑state quirks. Requirements for witnesses, notarization, revocation, and capacity standards vary widely.

- Electronic execution (Illinois). Illinois permits electronically executed POAs with e‑notary. In some situations, clients in other states can choose to execute under Illinois law—understanding they’re subject to Illinois execution standards.

Moving or signing out‑of‑state: Which law applies?

If you cross a border to sign a POA (say, you live in Iowa but sign in Illinois), you must meet the execution rules of the state where you sign. That can be a sound strategy—but only if you’re comfortable with that state’s requirements and downstream implications.

Watch‑out: We sometimes see conflicting agents or unrevoked older POAs from a previous state that were never properly revoked under that state’s rules—creating confusion for banks and providers. A clean paper trail (revocation + notification) matters.

College‑bound & young adults (18+): Don’t skip these

Once a child turns 18, parents lose default access to medical and school records. Hospitals face significant penalties for improper disclosures, so they won’t talk without proper authorization. For students (especially student‑athletes), put these in place:

- Medical POA + HIPAA release (so parents/guardians can receive information).

- Financial POA (to handle banking/bills while the student is away).

- FERPA waiver with the school (if educational access is desired).

Illinois families also have an extra, related tool: the Short‑Term Guardianship form, which can authorize a caregiver for up to 365 days without court involvement—useful in limited, practical scenarios. Acceptance outside Illinois can vary.

LGBTQ+ couples & unmarried partners: Contract for certainty

If national marriage protections were narrowed in the future—or for unmarried partners today—don’t rely on default state law. Use Healthcare and Financial POAs, HIPAA authorizations, and hospital visitation directives to contractually preserve ‘chosen family’ rights across jurisdictions.

A traveler’s checklist to minimize ‘no’

- Execute with two witnesses + notary, even if your state requires less.

- Attach a HIPAA release and, if available, an attorney/agent certification.

- Carry a one‑page wallet card listing your agent(s) and your attorney’s contact info; keep digital copies accessible to agents.

- Review and refresh POAs every 2–3 years or after major life changes; institutions are more comfortable with recent documents.

How Greenwood Law can help

We draft multi‑state‑savvy POAs with practical acceptance in mind, integrate certifications where appropriate, and help families implement HIPAA/FERPA and related documents. To schedule a consultation, visit www.greenwood.law or call 309‑517‑5415.

Important disclaimer

This post and the linked Lunch & Learn video are general information, not legal advice, and do not create an attorney‑client relationship. To retain Greenwood Law, you must sign a written engagement agreement with the firm.